FEED

CONTACT TERRIThink No One’s Buying Homes Right Now? Think Again.

If you’ve seen headlines saying home sales are down compared to last year, you might be thinking – is it even a good time to sell?

Here’s the thing. Sure, the pace of the market has cooled compared to the frenzy we saw just a few years ago, but that’s not a red flag. It’s a return to normal. And normal doesn’t mean nothing’s happening. Buyers are still out there – and homes are still selling.

Why? Because real life doesn’t pause for perfect conditions. There are always people who need to buy – and this year is no exception. Buyers who are in the middle of a big change in their lives, a new marriage, a growing family, or a new job still need to move, no matter where mortgage rates are. And they may be looking for a home just like yours.

Every Minute 8 Homes Sell

Let’s break it down using the latest sales data from the National Association of Realtors (NAR). Based on the current pace, we’re on track to sell 4.03 million homes this year (not including new construction).

4.03 million homes ÷ 365 days = 11,041 homes sell per day11,041 homes ÷ 24 hours = 460 homes sell per hour460 homes ÷ 60 minutes = roughly 8 homes sell every minuteThat means in the time it takes to read this, another 8 homes will sell. Let that sink in. Every minute, buyers are making moves – and sellers are closing deals.

The Right Agent Makes All the Difference

If you’ve been holding off on selling your house because you think buyers aren’t out there, let this reassure you – there are still buyers looking to buy.

But since the market is balancing out, selling today takes more than just putting up a sign in the yard. You’ve got to price your house right, market it well, and know how to reach the buyers who are ready to act. That’s where a trusted local agent comes in.

They’ll help you navigate this market, position your home to stand out, and guide you through every step.

Bottom Line

The market hasn’t stopped. Buyers are still buying. Life is still happening. And if selling your home is part of your next chapter, you can make it happen.

Roughly 11,000 homes are selling every day – and yours could be next. When you’re ready to take the next step, connect with a trusted local real estate agent so you have an agent to create that perfect strategy.

Why Big Investors Aren’t a Challenge for Today’s Homebuyer

Remember the chatter in the headlines about all the homes big institutional investors were buying? If you were thinking about buying a home yourself, you may have wondered how you’d ever be able to compete with that. Here’s the thing. That’s not the challenge so many people think it is – especially right now.

Let’s break down what’s really going on and why the recent shift in the approach investors are taking could tip the scales in your favor.

Large Investors Are Pulling Back

The truth is institutional investors never represented as big a share of the housing market as people think. And now, they’re backing off even more.

Today, big real estate investors aren’t buying as many homes. In fact, they’re actually selling more than they’re buying.

According to data from Parcl Labs, 6 out of 8 of the largest institutional single-family rental investment companies in America sold more homes than they bought in the second quarter of 2025 (see graph below):

And here’s the stat that really puts it in perspective. According to Dominion Financial, for every home being bought by big investors, about 1.75 are being sold.

What’s Causing Big Investors To Change Course?

The reason institutional investors aren’t buying as many homes now compared to recent years is actually pretty simple. It’s because home values aren’t rising as fast as they were a few years ago, but the costs associated with rental maintenance are.

Since most institutional investors buy homes to rent them out, those higher costs eat into their margins. Remember, to investors, homebuying is a business.

But you’re not buying a home just for this year or next. You’re buying a place to build a life, and that’s a long-term play.

Historically, home values tend to rise over time. So, while investors may be sidelined by what’s happening right now, you’re in a different position entirely. You have the chance to buy while competition is lower and benefit from potential long-term price appreciation – something most investors are choosing not to wait for as they focus on shorter-term returns.

What Does All This Mean for You?

According to a recent survey, about 55% of real estate investors have no plans to grow their rental portfolios now or in the near future. With big investors stepping back, that means less competition from deep-pocketed buyers. And since they’re adding to today’s for-sale inventory, it also creates more options for you.

Bottom Line

If you’ve been holding off on buying, now might be the time to take another look. Connect with a local real estate agent so you can get expert guidance on what’s available and what might be a good fit for you.

What kind of home would you be excited to make yours this year?

Top 5 Reasons To Hire a Real Estate Agent When You Sell

Some Highlights

The right agent doesn’t just list your house – they help you sell smarter, faster, and with fewer surprises.With an agent’s help, you’ll know what’s happening in your local market and how to price your house right. You’ll feel confident filling out complex legal documents and at the negotiation table. And that’s priceless.Connect with an agent so you have that expertise on your side.Multi-Generational Homebuying Hit a Record High – Here’s Why

Multi-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below):

And what’s behind the increase? Affordability. NAR explains:

And what’s behind the increase? Affordability. NAR explains:

“In 2024, a notable 36% of homebuyers cited “cost savings” as the primary reason for purchasing a multigenerational home—a significant increase from just 15% in 2015.”

In the past, caregiving was the leading motivator – especially for those looking to support aging parents. And while that’s still important, affordability is now the #1 motivator. And with current market conditions, that’s not really a surprise.

Pooling Resources Can Help Make Homeownership Possible

With today’s home prices and mortgage rates, it can be hard for people to afford a home on their own. That’s why more families are teaming up and pooling their resources.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

“There are a few ways to improve affordability, at least marginally. . . purchase a property with a family member — there are a growing number of multi-generational households across the country today, and affordability is one of the reasons for this.”

But this strategy doesn’t just help with affordability. It may even allow you to get a larger home than you’d qualify for on your own and that gives everyone a bit more breathing room. As Chris Berk, VP of Mortgage Insights at Veterans United, explains:

“Multigenerational homes are more than a trend: They are a meaningful solution for families looking to care for one another while making the most of their homebuying power.”

And momentum may be growing. Nearly 3 in 10 (28%) of homebuyers say they’re planning to purchase a multi-generational home.

Maybe it’s a solution that would make sense for you too. The best way to find out? Talk to a local real estate agent who can help you decide if this option would work for you.

Bottom Line

If your budget feels tight, buying a multi-generational home could be a smart solution.

Would you ever consider buying a home with a family member? Why or why not?

Connect with an agent to talk through your options.

What Every Homeowner Needs To Know In Today’s Shifting Market

Here’s something you need to know. The housing market is getting back to a healthier, more normal place. And even though it may not sound like it, this shift is actually a good thing.

It’s what you should expect. It’s just that our expectations have been skewed by the intense seller’s market over the past few years.

But what you need to remember is: there’s still plenty of opportunity to be had if you’re thinking about selling – whether that’s next month or next year. You just need to stay up to date on what’s happening in the market, and have a strategy that matches the moment. Here's your update.

1. Inventory’s Up. Buyer Power Is Coming Back.

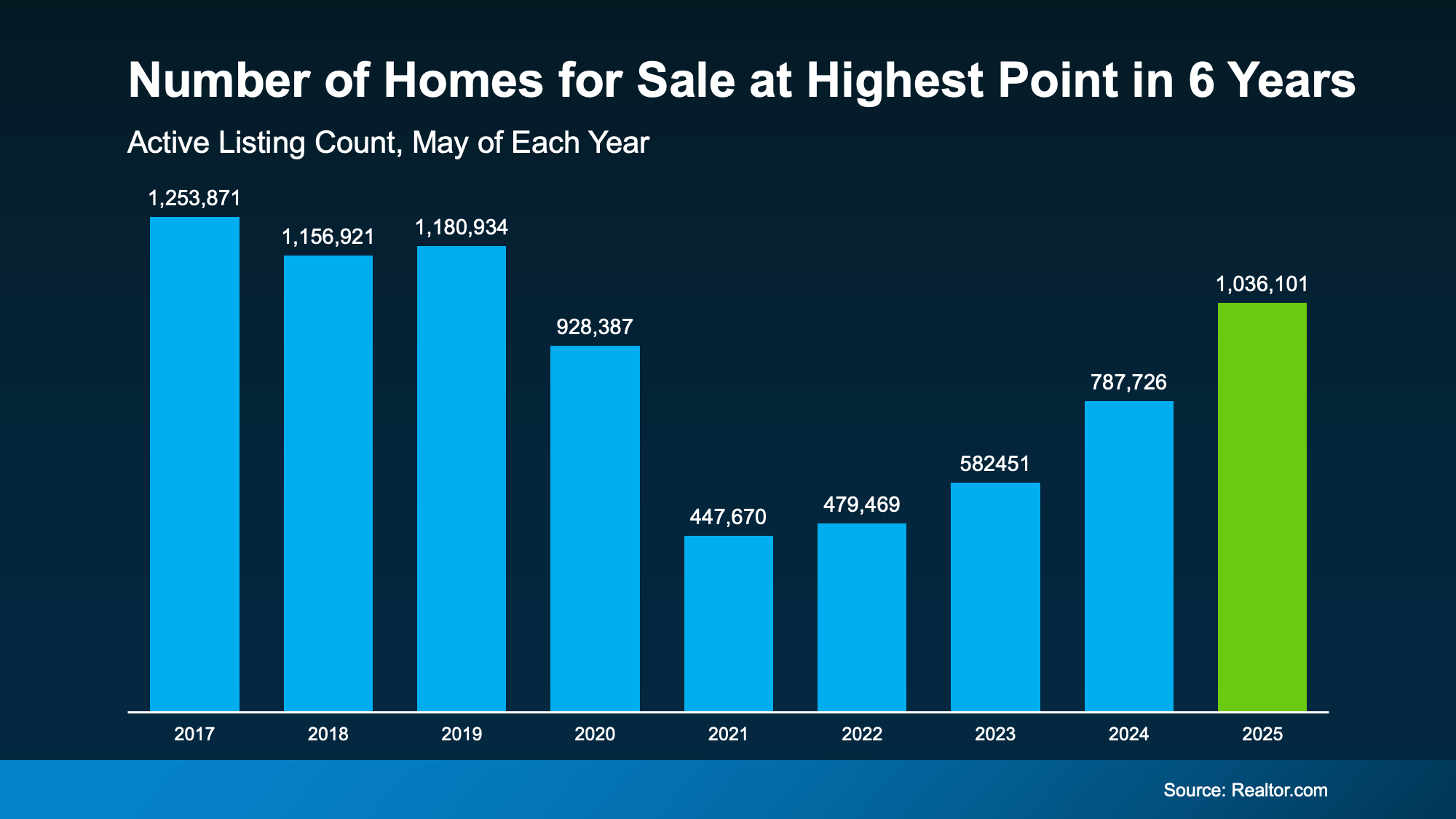

According to the latest data, the number of homes for sale is rising back toward more normal levels (see graph below):

But inventory growth is going to vary a lot based on where you live.

But inventory growth is going to vary a lot based on where you live.

If you’re in a market where the number of homes for sale is back to normal, buyers may have more sway than you’d expect. That doesn’t mean buyers have all the power – it just means they have more choices, so your home has to stand out.

But if you live where inventory is still pretty limited, you may see more buyers competing for your house.

No matter where you are, the key is to work with a pro who can help you adjust your game plan for your local market.

2. The Right Price Matters More Than Ever

With more homes to choose from, today’s buyers are quick to skip over homes that feel overpriced. That’s why pricing your house right is the secret to selling quickly and for top dollar. That’s a point Realtor.com really drives home:

“ . . . a seller listing a well-priced, move-in ready home should have little problem finding a buyer."

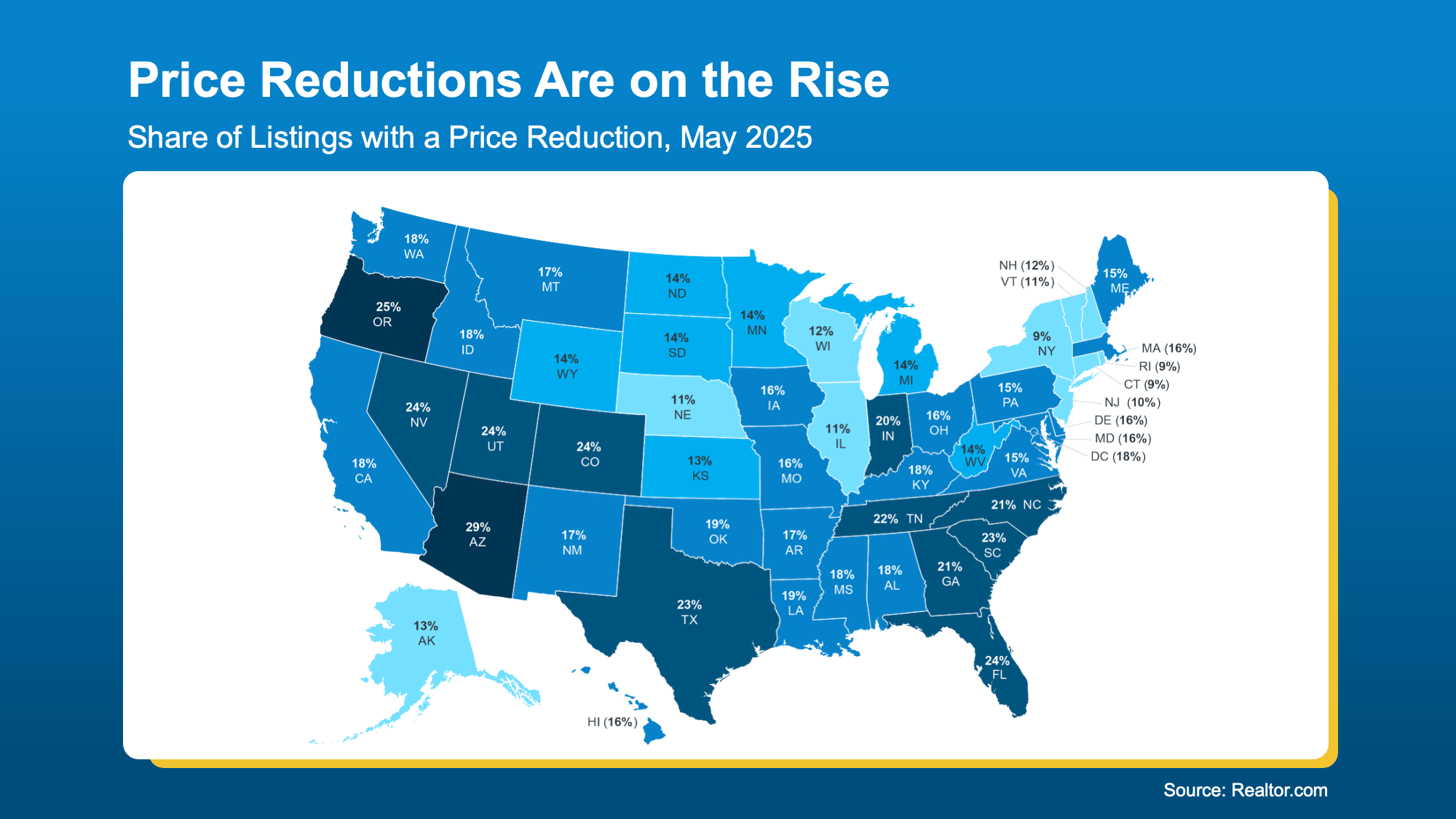

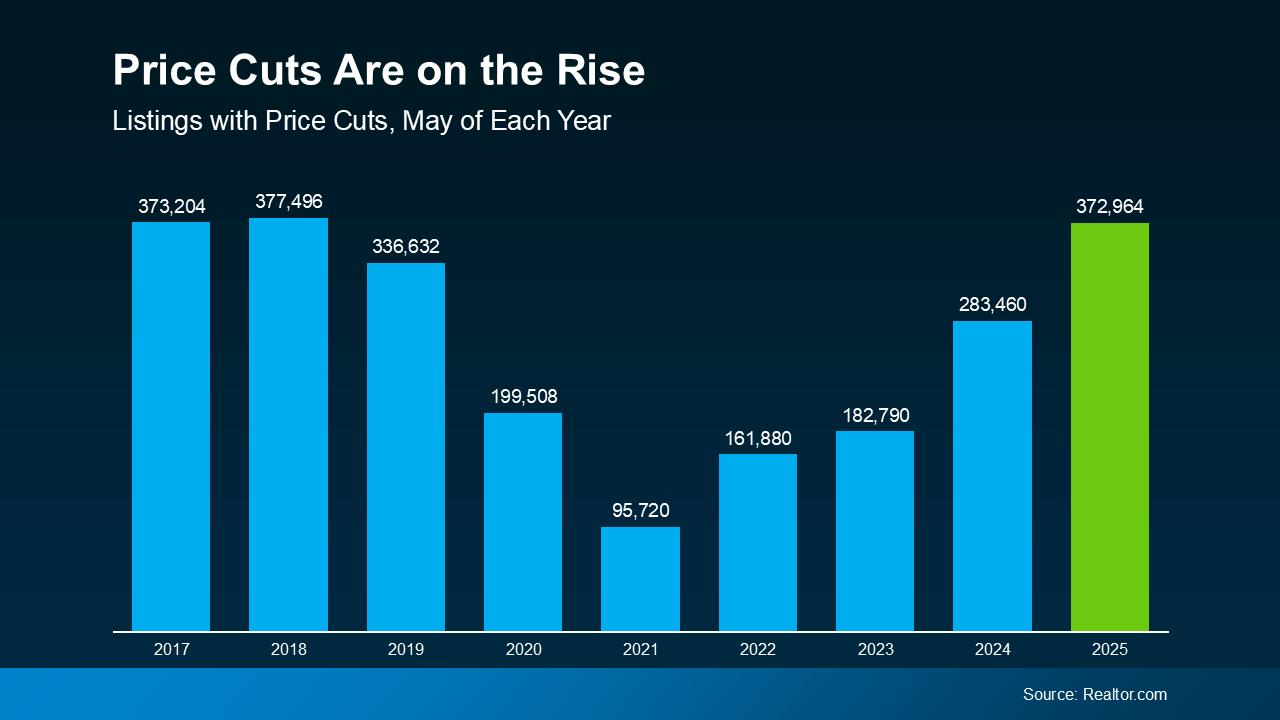

Miss the mark, though, and you may have to backtrack. Today, about 1 in 5 sellers (19.1%) are reducing their asking price to attract buyers (see map below):

Here’s how to avoid being one of those sellers who has to reduce their asking price. Danielle Hale, Chief Economist at Realtor.com, says:

Here’s how to avoid being one of those sellers who has to reduce their asking price. Danielle Hale, Chief Economist at Realtor.com, says:

“The rising share of price reductions suggests that a lot of sellers are anchored to prices that aren't realistic in today's housing market. Today's sellers would be wise to listen to feedback they are getting from the market.”

The best way to get that information? Lean on your local agent. They have the expertise to set a price that sells in any market. Because if your price isn’t compelling, it’s not selling.

3. Flexibility Wins Negotiations

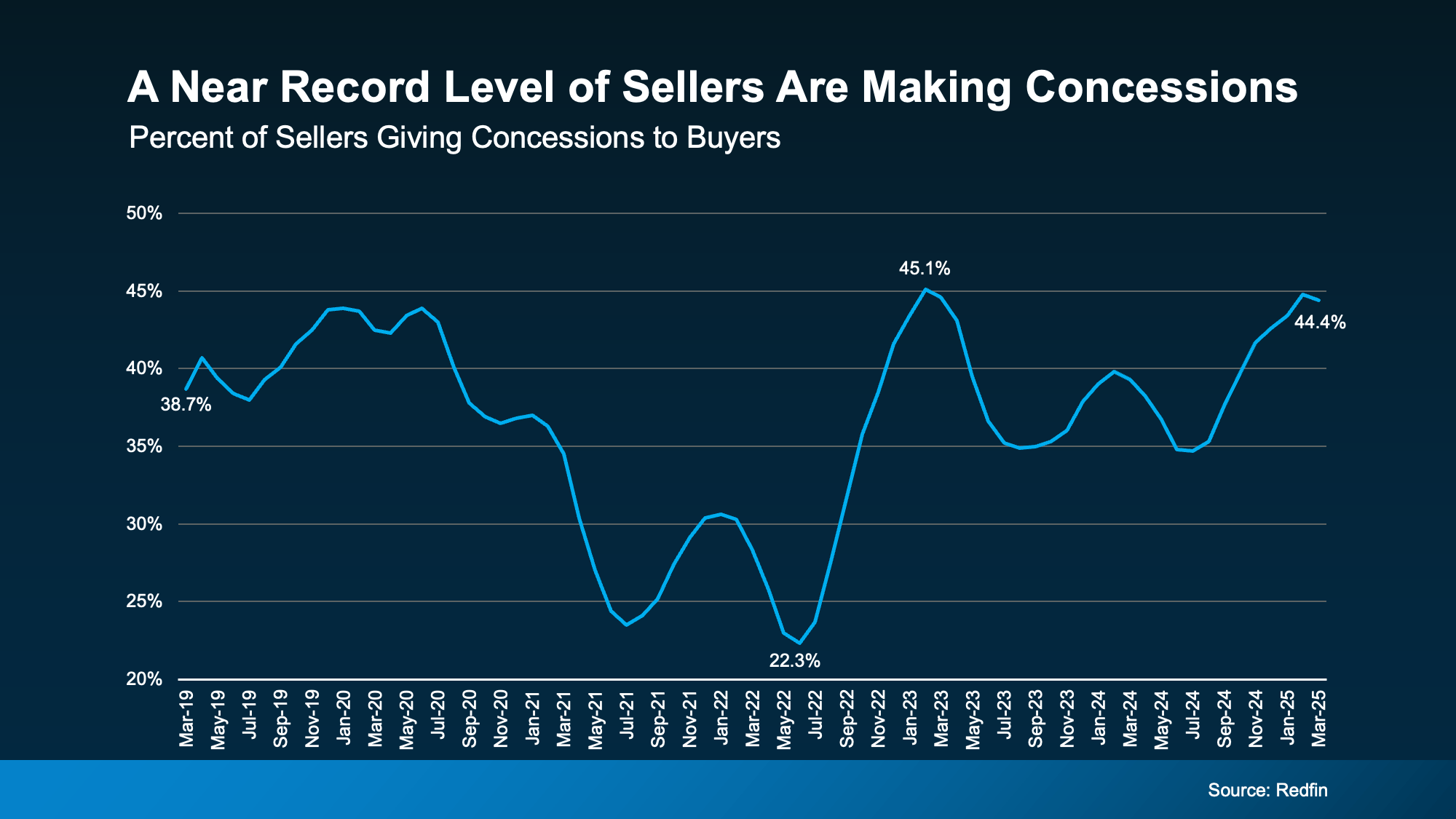

Gone are the days of buyers waiving inspections and appraisals just to get a deal done. Now, because they have more homes to choose from, buyers are able to ask for things like repairs, credits, and help with closing costs. And data from Redfin shows nearly 44.4% of sellers are willing to negotiate (see graph below):

The takeaway? This isn’t a bad market. It’s just a different one. And it’s in line with more normal years in the housing market, like back in 2019. The savviest sellers are the ones taking advantage of every opportunity to work with buyers and make their house shine.

The takeaway? This isn’t a bad market. It’s just a different one. And it’s in line with more normal years in the housing market, like back in 2019. The savviest sellers are the ones taking advantage of every opportunity to work with buyers and make their house shine.

And it’ll help if you think of concessions as tools, not losses. Use them to bridge gaps, sweeten deals, and get across the finish line. And don’t stress. Since prices went up roughly 55% over the past five years, you’ve got plenty of room to make a concession or two and still come out ahead.

Just be sure to work with your agent to understand which concessions could be the key to sealing the deal.

Bottom Line

Sellers who are going to succeed in the weeks and months ahead are the ones who understand this market shift and lean into it with the right expectations and the right strategy.

Connect with a local agent and talk about what’s working in your area right now – and how to make those wins work for you, too – whenever you’re ready to make a move.

Think It’s Better To Wait for a Recession Before You Move? Think Again.

Fear of a recession is back in the headlines. And if you’re thinking about buying or selling sometime soon, that may leave you wondering if you should reconsider the timing of your move.

A recent survey by John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) shows 68% of people are delaying plans to buy or sell due to economic uncertainty.

But it may not be for the reason you think. Not everyone is holding off because they’re worried. Some buyers are waiting because they’re hopeful. According to Realtor.com:

“In 2025Q1, 3 in 10 (29.8% of) surveyed homebuyers said a recession would make them at least somewhat more likely to purchase a home . . . This reflects a common dynamic where some buyers see a downturn as an opportunity. If the economy enters a recession, the Federal Reserve may respond by lowering interest rates to stimulate activity, potentially putting downward pressure on mortgage rates and easing affordability concerns. As a result, buyers—especially those with limited down payments—might view a recession as a more favorable time to enter the market.”

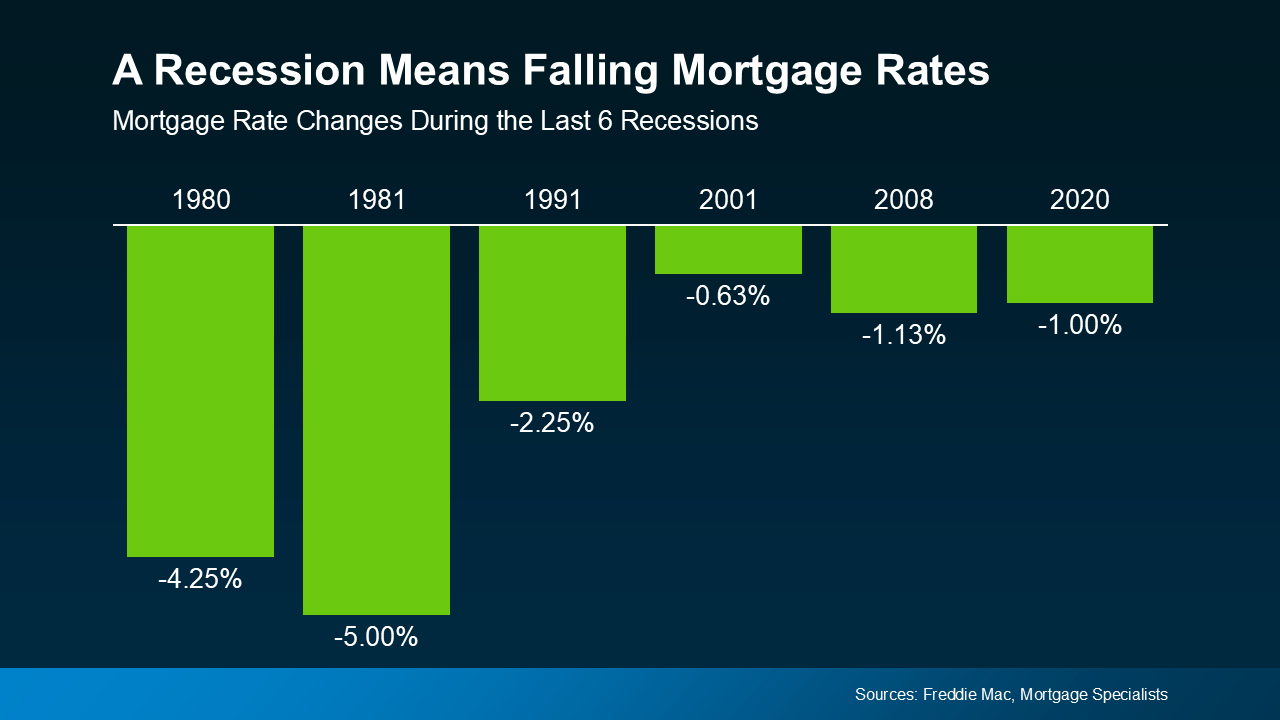

And there’s some truth to the idea that a recession could bring about lower mortgage rates. History shows mortgage rates usually drop during economic slowdowns. That’s not guaranteed – but it is a common pattern. Looking at data from the last six recessions, you can see mortgage rates fell each time (see graph below):

But here’s what those buyers may not be considering. Many of those hopeful buyers are assuming something else will happen too – that home prices will drop. And that’s where history tells a different story.

But here’s what those buyers may not be considering. Many of those hopeful buyers are assuming something else will happen too – that home prices will drop. And that’s where history tells a different story.

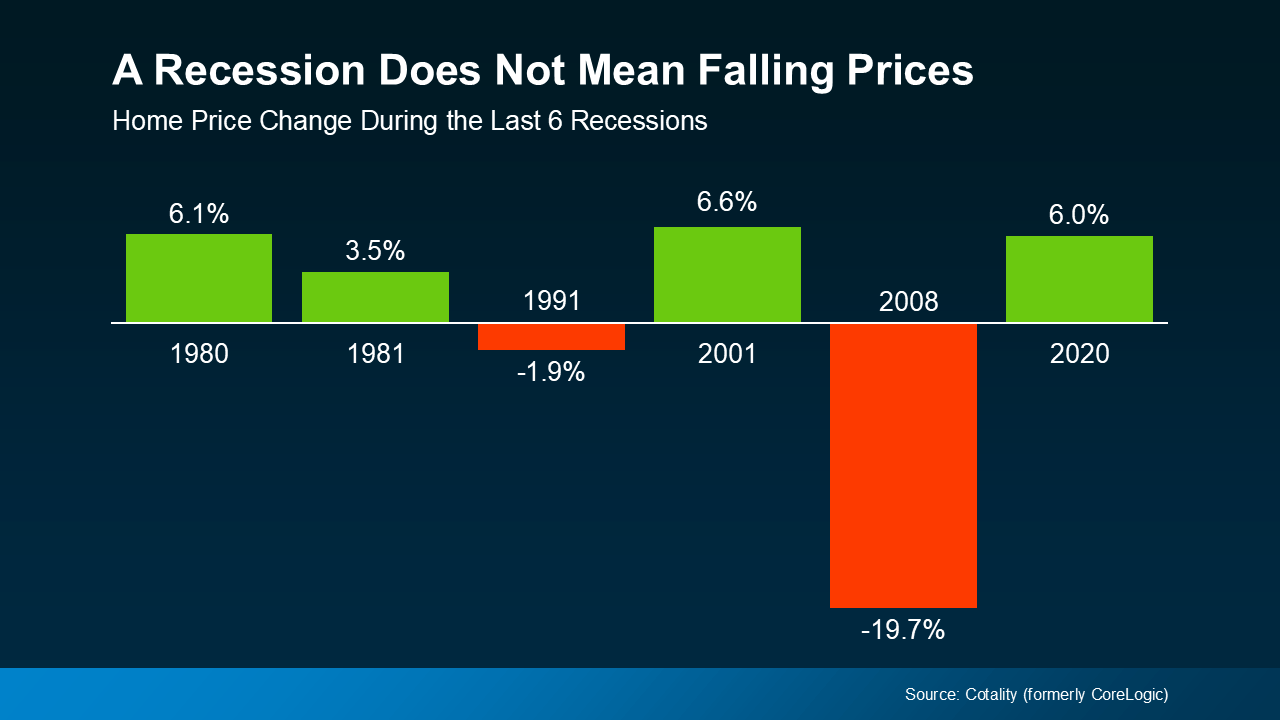

According to data from Cotality (formerly CoreLogic), home prices went up in four of the last six recessions (see graph below)

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing inventory deficit, even as the number of homes on the market is rising.

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing inventory deficit, even as the number of homes on the market is rising.

Since prices tend to stay on whatever path they’re already on, know this: prices are still holding steady or rising in most metros, although at a much slower pace. So, a big drop isn’t likely. As Robert Frick, Corporate Economist with Navy Federal Credit Union, explains:

"Hopes that an economic slowdown will depress housing prices are wishful thinking at this point . . ."

Bottom Line

If you’ve been waiting for a recession to make your move, it’s important to understand what really happens during one – and what likely won’t. Lower mortgage rates could be on the table. But lower home prices? That’s far less likely.

Don’t wait for a market that may never come. If you’re thinking about buying or selling, connect with an agent to talk through what today’s economy really means for you – and make a smart plan that works in your favor, regardless of what the headlines say.

Why Your Home's Asking Price Matters More Today

Some Highlights

A growing number of homeowners are overestimating today’s market. And that’s why the number of sellers dropping their price is back at normal levels.A lot of the time this is happening because they’re not paying attention to current conditions. The best way to avoid that mistake? Lean on the expertise of an agent.If you want a proven pricing strategy that works for today's market, connect with a local agent.Why Homeownership Is Going To Be Worth It

Life can feel a bit unpredictable these days. What’s happening with inflation? The economy? The housing market? But in the middle of all that uncertainty, there’s one thing a lot of people still crave – a place to call their own.

Because when everything else feels up in the air, home can be the thing that grounds you. As the experts at 1000WATT put it:

“Homeownership isn’t primarily financial anymore. . . Across all demographics, emotional and lifestyle factors consistently outrank wealth-building as motivators.”

Here’s what owning a home can mean for you, especially right now.

Freedom To Make It Yours

When you're a homeowner, you don’t need to ask permission to paint a wall, hang a gallery of your favorite art, or redo the floors. You have the freedom to create a space that reflects who you are, all the way from the light fixtures to the paint colors.

Pro Tip: Just be mindful about exterior changes, if you buy a home in a community that has a homeowner’s association (HOA). There may be some approvals you’d need to get for select outdoor changes.

More Privacy, More Peace

Owning your home can give you a sense of peace you didn’t even realize you were missing. It’s a comfortable place where you feel secure and can relax, enjoy your privacy, and unwind after a long day.

Room To Grow

Whether it’s starting a family, setting up a home office for your new career, or finally building that home gym in the garage so you can hit your fitness goals, owning gives you the space to live life on your terms.

A Stronger Sense of Community

When you own, you’re not just passing through, you’re putting down roots. That often leads to stronger ties with your community, more connection to your neighborhood, and a deeper feeling of belonging where you live. That’s very different from the temporary nature of renting.

A Feeling of Accomplishment

There’s something powerful about getting the keys and walking into your own front door for the first time. It’s more than pride, it’s personal satisfaction. A quiet and meaningful sense of “I did this.”

Sure, it’s not always easy for first-time homebuyers right now. The market today requires patience, strategy, and sometimes a little creative problem-solving. But it’s still worth it. As Realtor.com says:

“Buying a home is a major commitment, but it’s also incredibly rewarding.”

When you get those keys in your hand, when you realize this place is where your life gets to unfold, it clicks. The stress, the waiting, the planning – all of it led you home.

Bottom Line

There are a lot of things out of your control right now. But building a life in a space that’s truly yours? That’s still possible with the right strategy and expert help. Talk to a local agent about how to make it happen.

What would it mean for you to finally have a place to call your own?

3 Reasons To Buy a Home This Summer

Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do next. But here’s something only the savviest buyers realize:

This summer might actually be the best time to buy in years. Here are three big reasons why.

1. You Have More Negotiating Power

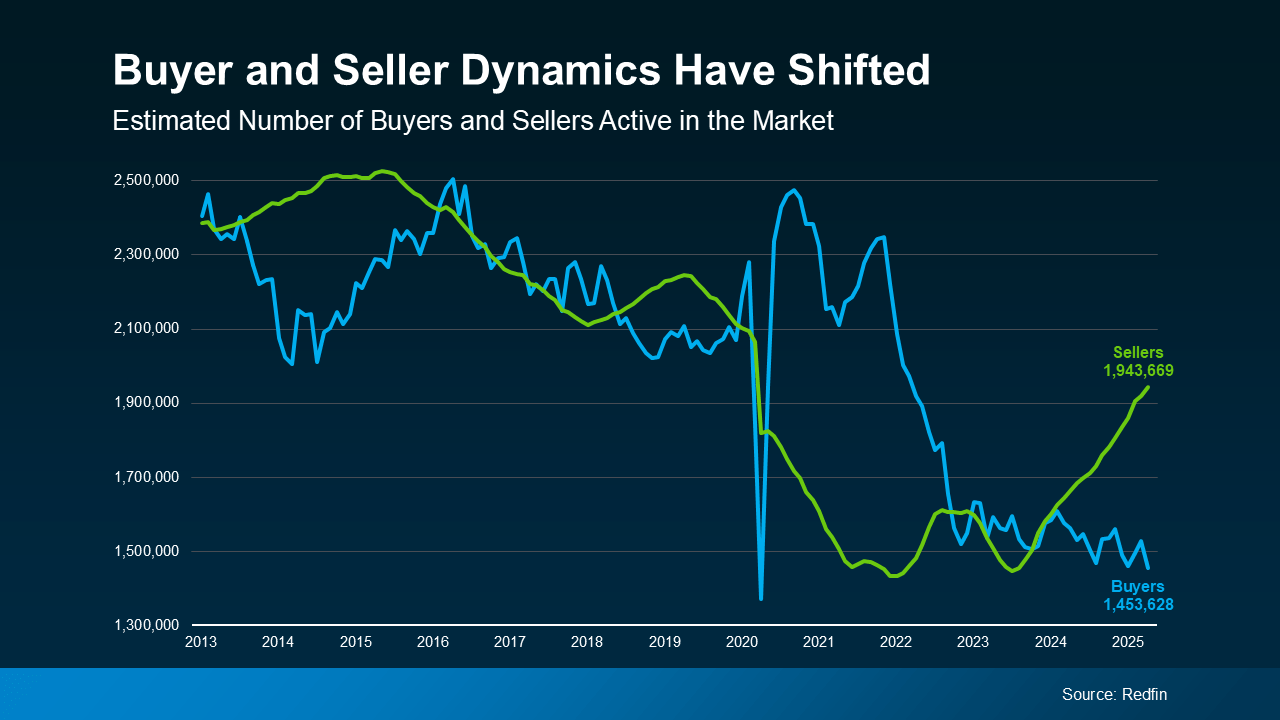

After several years of sellers having all the leverage, things are starting to shift. Check out the graph below. It uses data from Redfin to show that right now, there are more sellers active in the market than buyers:

Take a look at what happened back in 2021 through roughly 2023. In that time period, there were far more buyers (the blue line) looking to buy than homes for sale (the green line). That’s what drove the intense competition, bidding wars, and the exponential price growth the market saw back then.

Take a look at what happened back in 2021 through roughly 2023. In that time period, there were far more buyers (the blue line) looking to buy than homes for sale (the green line). That’s what drove the intense competition, bidding wars, and the exponential price growth the market saw back then.

Now, the market has shifted, and buyers are regaining their negotiating power as a result. With more sellers than buyers, sellers may be more willing to pay for repairs, cover some of your closing costs, or lower their asking price. The return of this kind of normal balance is a sign of a much healthier, more sustainable market. As Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), explains:

“ . . . with housing inventory levels reaching five-year highs, homebuyers in nearly every region of the country are in a better position to negotiate more favorable terms.”

And just in case you're worried there are too many homes on the market, here's what you should know. Overall inventory is still lower than normal, so you don’t have to worry about a nationwide oversupply or a crash.

2. You Have More Choices

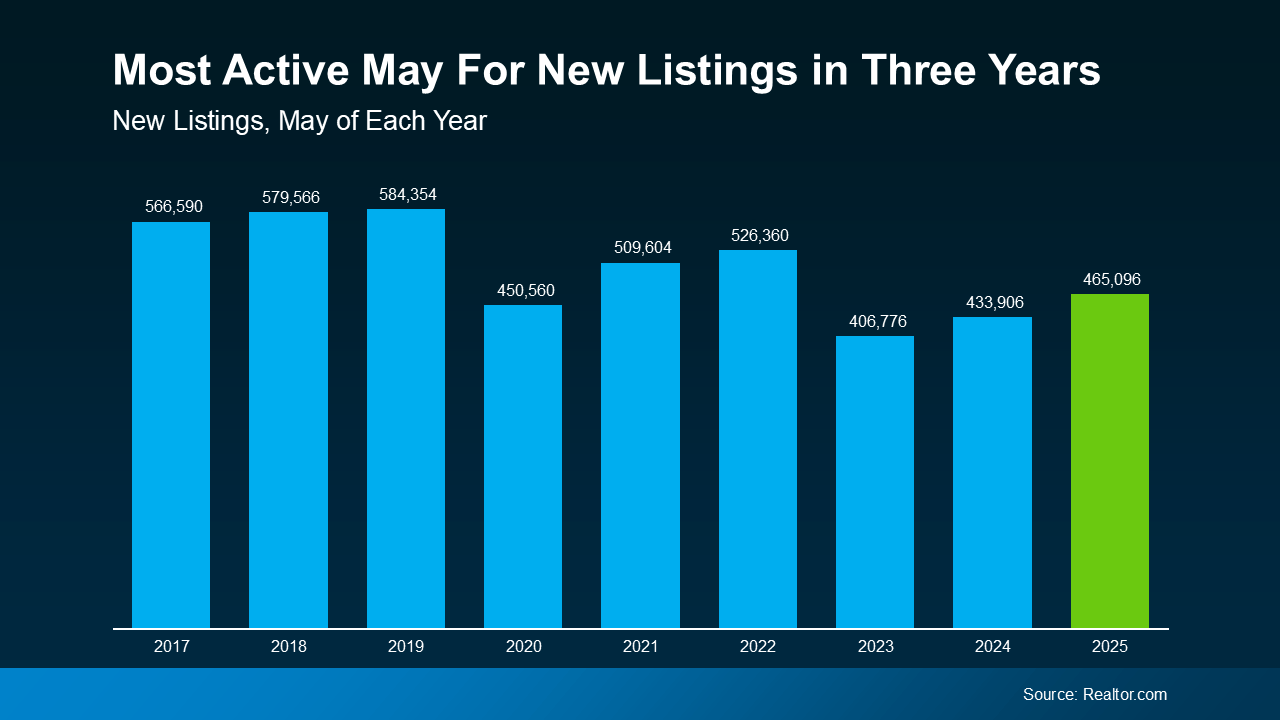

The number of homes for sale has improved a lot. Based on the latest data from Realtor.com, more homes were listed this May than in May 2024 or May 2023 (see graph below):

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

“With more fresh inventory hitting the market, buyers have better opportunities to find a home that fits their needs."

3. You May See More Flexibility on Price

With more homes for sale, they’re not selling at the same frenzied pace they were just a few years ago.

Since homes are taking more time to sell, some sellers are choosing to lower their asking prices to draw buyers back in or speed up the process. And that's to-be-expected. According to Realtor.com, 19.1% of listings had a price cut this May (see graph below):

That’s the fifth straight month where more sellers have reduced their price. And, as of May, the volume of price cuts is back at normal levels. This is yet another sign of the return to a more balanced market.

That’s the fifth straight month where more sellers have reduced their price. And, as of May, the volume of price cuts is back at normal levels. This is yet another sign of the return to a more balanced market.

While you shouldn’t expect a big discount, you may find sellers are a bit more flexible right now. As a recent article from The Street says:

“Although sellers have had the upper hand in the housing market over the past few years, houses are now staying on the market for longer, shifting negotiating power back to homebuyers.”

Just remember, most sellers still aren’t adjusting their prices – just the ones who overpriced to start with. So, this isn’t a sign of a crash, it’s a sign of some sellers having outdated expectations in a shifting market.

Bottom Line

This summer brings a powerful combo for buyers: more homes to choose from, less competition, and sellers being more flexible on pricing. If you’re ready to make a move, connect with a local real estate agent. They’d love to help you take the next step.

What would finding the right home this summer mean for your next chapter?

Why More Sellers Are Choosing To Move, Even with Today’s Rates

It’s hard to let go of a 3% mortgage rate. There’s no question about it. It’s the main reason why so many homeowners have delayed their move in recent years. But here’s something to consider.

While your low rate might be ideal, it doesn’t make up being too cramped, having a staircase your knees can’t handle anymore, or being 1,000 miles from your family. And those real-life needs are pushing more sellers off the fence despite today’s rates.

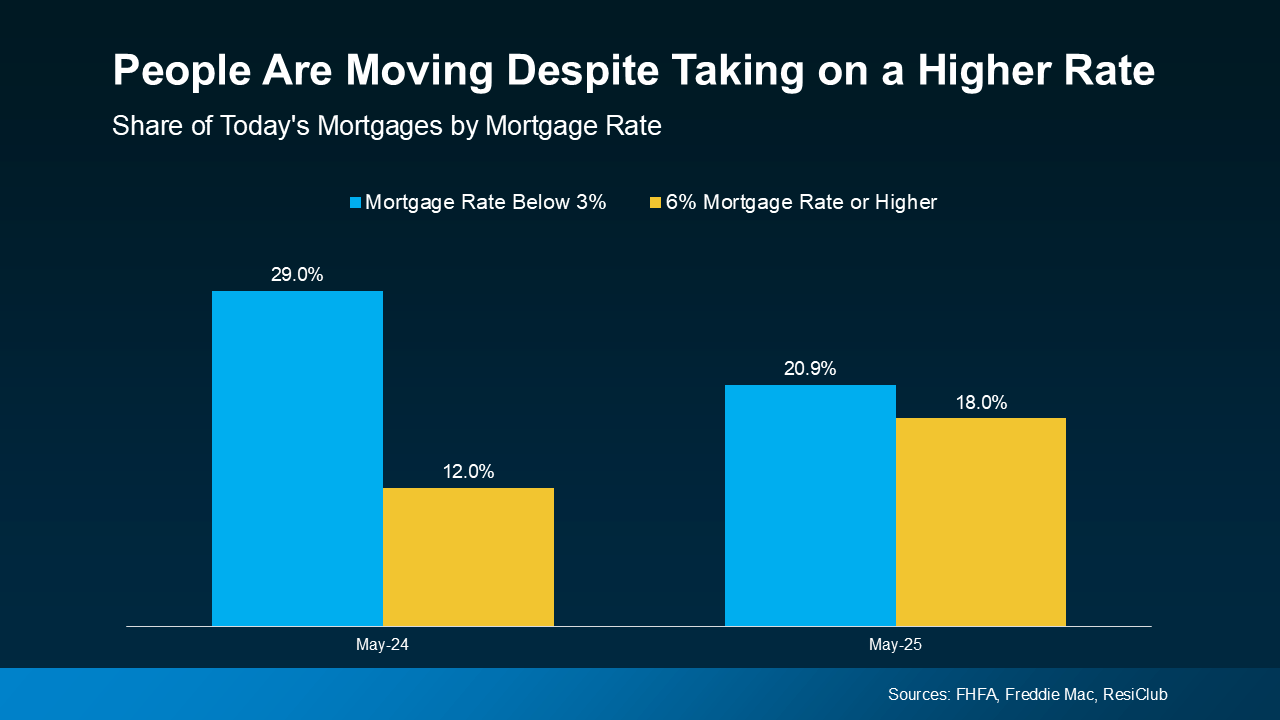

Data shows the share of homeowners with a mortgage rate below 3% is dropping as more people move. And, as a result, the share of homeowners taking on a mortgage rate above 6% is rising, too (see graph below):

The Biggest Reasons People Are Moving Right Now

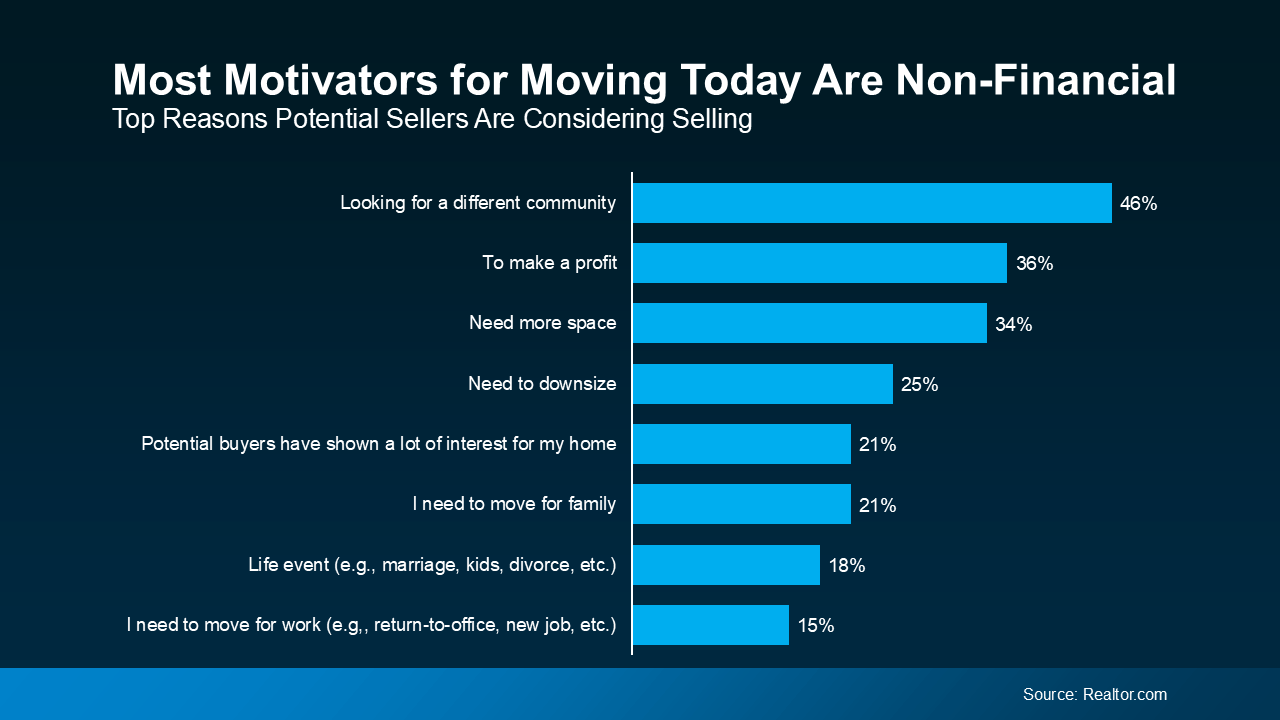

Why are some homeowners willing to take on a higher rate? A survey from Realtor.com helps shed light on that. It shows 79% of homeowners considering selling today are doing it out of necessity. And that same survey says most of the necessary reasons people are moving are non-financial in nature (see graph below):

Do any of these reasons resonate for you, too?

Do any of these reasons resonate for you, too?

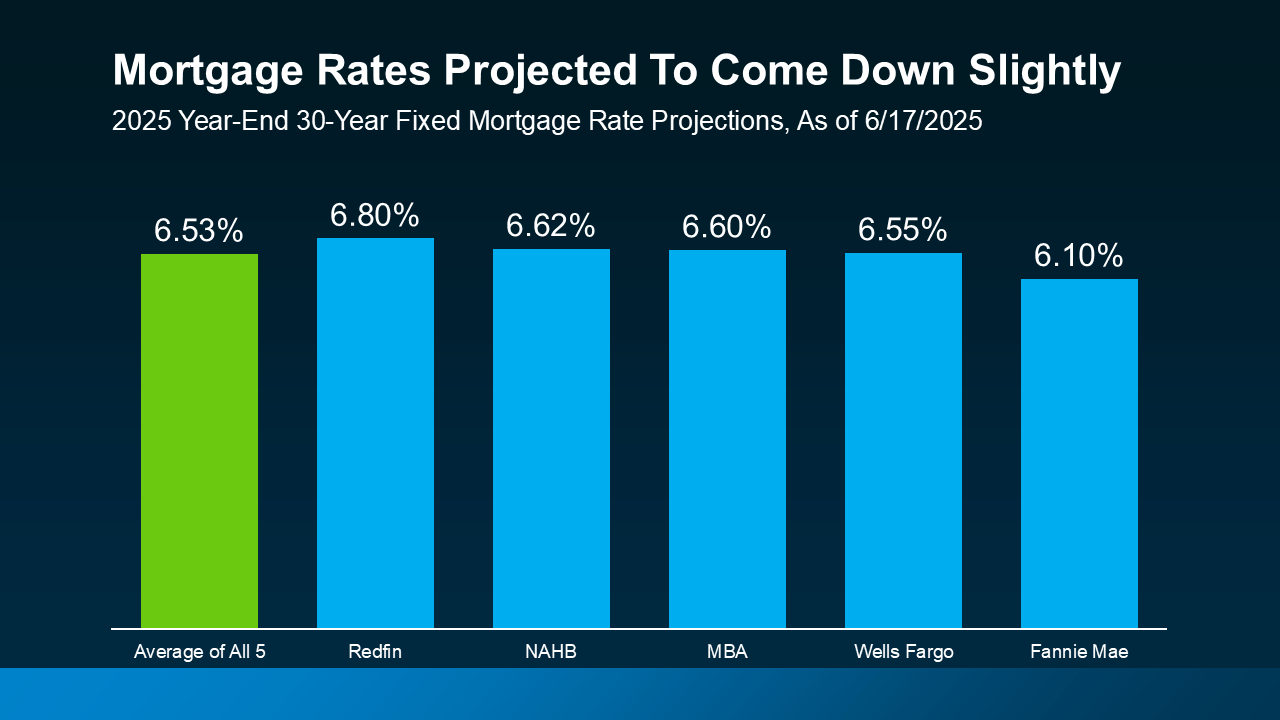

What About Mortgage Rates?

Yes, experts expect mortgage rates to ease, but slowly. The latest projections show only modest declines this year – not the 3% you may be hoping for (see graph below):

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

According to Realtor.com, nearly 2 in 3 potential sellers have been thinking about moving for over a year. If you’re one of them, maybe it’s time to ask:

How much longer are you willing to press pause on your life?

Bottom Line

Maybe your current house fit your life five years ago. But that “for now” house you bought in 2020? It just can’t deliver on what you need in 2025. And that’s not just okay, it’s normal.

Mortgage rates are part of the equation, for sure. But the bigger question is:

What kind of home do you need to support the life you’re living now?

Talk to an agent about what’s changed, and what kind of move would actually take your life forward.